Look at the Tabs. This shows the amount due to HMRC.

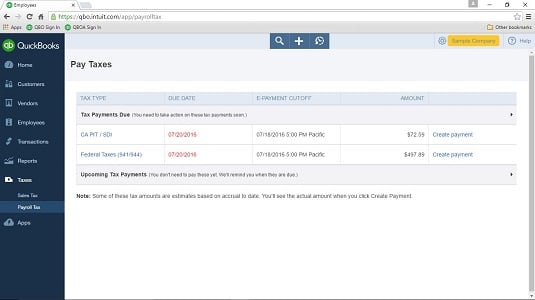

In the QuickBooks Online Navigation bar select Taxes.

How to pay payroll liabilities in quickbooks online. You can go to the Payroll Taxes page to pay those due liabilities and remove them from the Balance Sheet. Go to Taxes and click the Payroll Tax tab. Click Pay Taxes or the View all link.

Find the taxes you want to pay then hit Record Payment. More details about paying your payroll taxes can be found here. Pay and file payroll taxes online.

Im here to share additional information in paying your payroll liabilities in QuickBooks Online. We can run the Employment Payment Record P32 report. This shows the amount due to HMRC.

To access the report. Go to view your reports in QuickBooks. Under Employment Payment Record select Run.

Select the current year. Once you turn on manual payroll you can choose Employees - Payroll Taxes and Liabilities - Create custom liability payments. Then you just choose the period you are paying the payroll taxes for and create a check.

Do not use the Write Checks window to pay liabilities. Instead create payroll liability checks to pay a payroll liability. By creating payroll liability checks QuickBooks Desktop can accurately track how much tax and other liabilities youve paid as well as how much you still owe.

How to complete any Form PD7A online. On the site with all the document click on Begin immediately along with complete for the editor. Use your indications to submit established track record areas.

Add your own info and speak to data. Make sure that you enter. Quickbooks 2019 Tutorial for Beginners - How to Pay Payroll Liabilities - YouTube.

Likewise how do I pay tax liabilities in QuickBooks online. From the Employees menu select Payroll Center. In the Payroll Center select the Pay Liabilities tab.

In the Pay Taxes Other Liabilities section select the liability to pay and select the ViewPay button. Review the liability for accuracy. Select the E-Pay button.

How do I credit payroll liabilities in QuickBooks. Look at the Tabs. A regular Write Check has an Expense and an Items tab.

You need to be looking at a Pay Liability check which has the Expense and the Liabilities tab. You need to use the function because when you are running payroll every data flow to the accounting is. One of my clients was issued a credit for State Withholding.

Here are the steps I used to enter the credit in QBO Payroll Essentials. Navigation Bar Taxes Payroll Taxes Enter Prior Tax History. After you have completed setting up payroll in QuickBooks you can now process your first pay run.

Follow these three steps on how to do payroll in QuickBooks Online. Go to your Payroll dashboard and then click the Run payroll. Here is a tutorial showing how to avoid a common error when paying payroll liabilities in QuickBooks.

In QuickBooks choose Employees Payroll Taxes and Liabilities Create Custom Liability Payments. In the Select Date Range For Liabilities window set the correct dates in the From and Through fields and click OK. In the Pay Liabilities window click the Payroll Item drop-down arrow and select the taxes you paid by credit card from the list.

Reconcile Payroll liabilities in QuickBooks Online. In the QuickBooks Online Navigation bar select Taxes. Click on Payroll Taxes option and under Pay taxes press Enter prior tax history.

Choose Current Year and Liability Period. After you click Add Payment select Tax Type to. To schedule and pay your federal and state tax liability in QuickBooks you must first set up your payment schedule.

To do this go to Employees then Payroll Taxes and Liabilities then Pay Scheduled Liabilities. At the bottom of the screen under Other Activities click Manage Payment Methods. Create a new tag group.

Go to Settings and choose Tags. Select New then Tag Group. Name the new tag group Payroll Liabilities.

Click in the box under Tag Name and enter a tag label ie EE to represent employee transactions as discussed above. To do so you need to follow certain steps and guidelines. Here are the steps.

First you are required to print out the particular payroll register. Then match the particular employee time cards in order to pay the register. Go to the Employees menu then Payroll Taxes and Liabilities and select Adjust Payroll Liabilities.

Use these tips to help complete the fields. From the dashboard of your QuickBooks Desktop application click the Employees tab and select Payroll Taxes and Liabilities. Select Adjust Payroll Liabilities and then select the date on which you want the adjustment.

Now select the Effective Date for the adjustment. Select Company under the Adjustment is. Select Employees in the QuickBooks Desktop.

Select Payroll Center and then click on the Payroll Liabilities tab. From the drop-down list of Other Activities select Change Payment Method. Select Benefit and Other Payments from the QuickBooks Payroll Setup window.

Payroll liabilities are any type of payment related to payroll that a business owes but has not yet paid. A payroll liability can include wages an employee earned but has not yet received taxes withheld from employees and other payroll-related costs. Do this by clicking the PayView.

Button to create a liability check. QuickBooks will give you a warning the first time you try to pay a payroll liability with a regular check but after you ignore the message once it never comes back. Do you have issues in adjusting Payroll liabilities in QuickBooks Online.

Call our Toll-Free 1-818-296-0721 QuickBooks Payroll Support number. Reconcile Payroll liabilities in QuickBooks Online In the QuickBooks Online Navigation bar select Taxes. Click on Payroll Taxes option and under Pay taxes press Enter prior tax history.